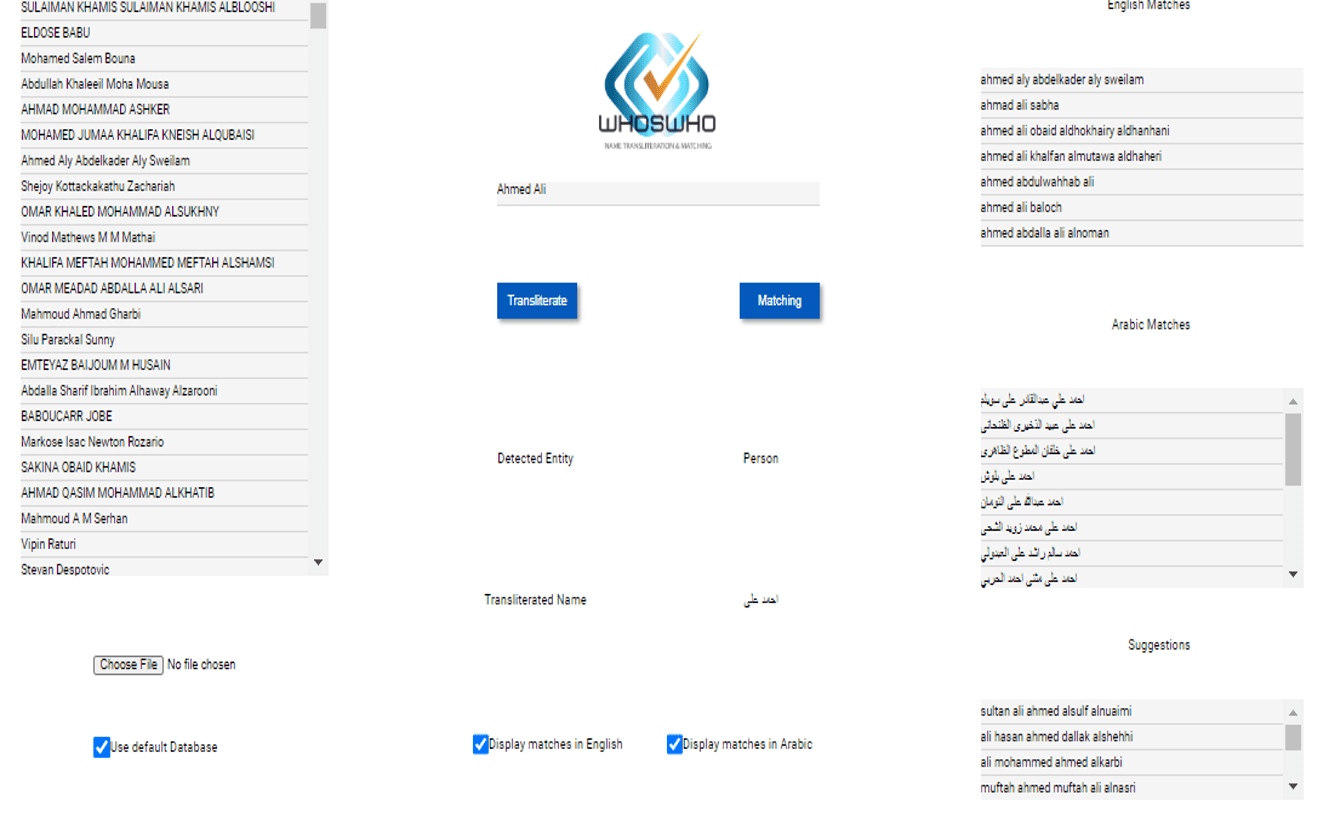

WHOsWHO – Name Transliteration & Matching

Matches individuals names against a list of potential name variations across databases

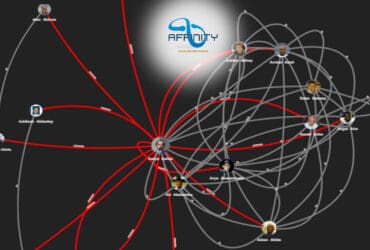

Know your customers, predict behavior and connect the dots.

Maintaining visibility on customers’ access and behavior is essential for organizations seeking to optimize customer relations while managing the associated risk across their entire lifecycle in order to build a long-lasting relationship. It starts with identity tracking and proceeds to monitoring behavior and detecting anomalous behavior, as well as looking at potential links and similarities between customers. It is all about gaining a holistic view of customers.

Matches individuals names against a list of potential name variations across databases

Analyze behavior, discover similarities, manage risk

Detecting links and hidden relations between actors in a networked community